Mortgage Pools

A mortgage pool is a collection of notes secured by deeds of trust. Investors invest in membership interests in the mortgage pool. Much like a mutual fund product, it’s a way for investors to pool their assets so they can participate in a variety of individual investments.

Rules for participating in mortgage pools are regulated by federal and state securities laws. Pools are limited by the number of participating investors, and sometimes restricted by state residency. There is a required minimum investment period of twelve months. Once this period has elapsed, withdrawals are handled on a request basis. There are no penalties for withdrawals. We can provide more detail on these restrictions if you choose a mortgage pool.

The Foundation Fund, LLC and The First Floor Fund, LLC offer an easier way to tap the benefits of trust deed investing

If you are considering investing in trust deeds, but desire more diversification, liquidity, and flexibility, a mortgage pool investment could be right for you. Much like a mutual fund, a mortgage pool is a portfolio of real estate loans funded collectively by multiple investors, each purchasing shares in the pool. Interest payments are paid out proportionately as monthly dividends. By allowing an investor to spread their investment across all the loans in the fund, mortgage pools offer greater diversification than investing in individual trust deeds.*

Diversification. By allowing an investor to share in multiple trust deeds, mortgage pool investing provides significant diversification within the investor's trust deed position - further reducing risk.

Convenience. Mortgage pools allow investors to invest in multiple trust deeds with the bookkeeping convenience of a single investment. What's more, there is no need to reinvest capital returned when loans are paid off - it's automatically reinvested in new loans as long as your investment in the fund remains active. (This is one reason that a mortgage pool can be a great option for IRAs, Coverdell accounts, and other tax-advantaged retirement and college savings accounts.)

Dividend reinvestment. Because monthly interest payments are distributed to shareholders as dividends, investors have the option to reinvest their yields automatically.

Liquidity. Investment in individual trust deeds are locked in until the loan matures - but, shares of a mortgage pool can typically be sold at any time after 12 months after the initial investment date.

Sterling Pacific Financial protects investor interest by applying its time-tested approval framework to all loans funded by its two pools, The Foundation Fund, LLC and The First Floor Fund, LLC. Among our requirements are strict loan-to-value maximums of 75% on residential properties, 65% on commercial properties, and 50% on unimproved land. All properties tied to The Foundation Fund are based in California, while First Floor Fund properties are restricted to AZ, CA, NM, NV, OR, and WA. Focusing our lending efforts on regions in which we have significant experience helps us manage risk.

While our two pools share the same investment strategy and approach, there are other differences you should consider. The Foundation Fund, LLC lends only in California and is open only to US investors residing in California. The First Floor Fund, LLC can accept investment from citizens residing anywhere in the US. Geographic differences contribute to a slight difference in target yields for the two funds. Additionally, investor suitability standards for the two pools differ. For The Foundation Fund, LLC, a total net worth of $500,000 (net of home) or $250,000 with an annual income of at least $65,000 is required. For The First Floor Fund, LLC, non-home net worth of $1,000,000 or annual income of $200,000 (for an individual) or $300,000 (for a couple) is required. Lastly, only The Foundation Fund, LLC can currently accept investment through tax-advantaged retirement and education savings accounts at this time.

While our mortgage pools have risks like any investment, and past performance is no guarantee of future performance, you may be interested to know that our pools have consistently delivered yields from 10-12% on average since inception. We are also proud that we engage Armanino, the largest CPA firm in California and a recognized leader in mortgage pool accounting, to independently audit our pools on behalf of our investors.

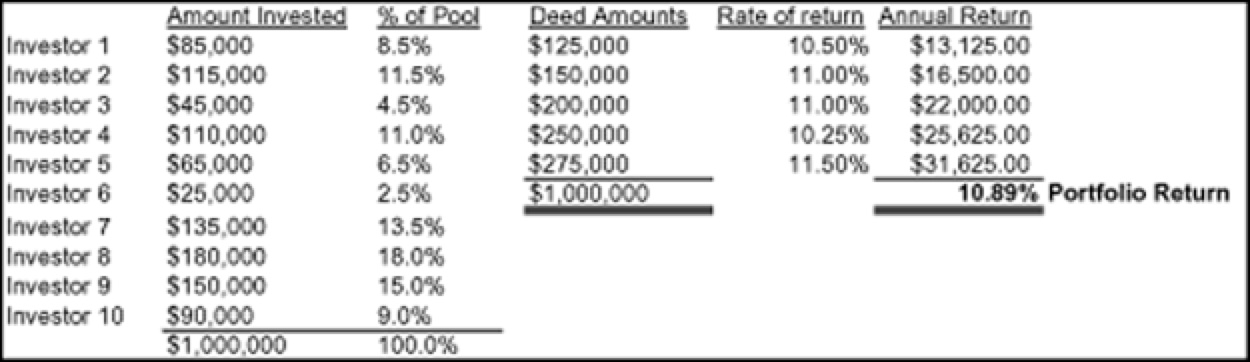

*In the example below, even the smallest investment of $25,000 is spread across all five loans in the pool, and earns the blended rate of 10.89% return.